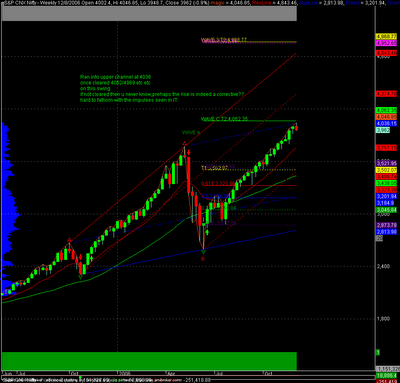

What if break above 3774 is a fake one??

No real way to know for sure but here is one thought for the fundamental investors

if cmp of nifty is 3774

and p.e is 20x (using rough figures here just bear with me please 10-20 pts and a few decimal pts 19.9 20.1 won't affect the outcome significantly :))

Current earnings = 3774/20 = 189

Next year's earnings using 15-22% growth = 217 - 230 (this comes from 6-10% gdp + 4% inflation so 15% is almost the bare min one would expect for nifty. The actual figure is likely to be much higher since nifty 50=best 50 companies of India and they can be expected to outperform gdp growth)

Now using savings rate of 7.25 % per year we get:

Earnings yield on savings deposit = 13.8

Nifty would be attractive if it was priced at a level such that it was priced at 13.8 times future expected earnings?

So the band we come up with is 217*13.8 - 230*13.8

= 2999.4-3174

Fits closely for a wave C down = A target of 2874 :)

or close enough anyway

P.S this just a one year discounting. I leave it as an exercise for savvy investors to use a longer term discounting model and come up with a suitable valuation. If looking over a horizon of 5-10 years then 15% cagr can really add up and give you huge returns in excess of a savings deposit even if current p.e were to be 30+.