I find that making a loss in the market is great motivation to try out something new and make something better. (I recently had a loss in chennpetro :))

Most people have ridiculed my mechanical approach at one point of time or another. When it comes to Trading system development/testing I have actually recieved more help/encouragement from my few friends in Europe than the many (online) friends in India.

I guess us Indians are more emotional than logical. Acting on cold hard facts and patterns would not be our forte. We would put in the emotional gut feel trading style in it anyway :). I have a mixed upbringing, partially western and partially desi in my values hence I seek the middle ground. A mechanical system is fine for guidance but it should be designed in such a way that it can be followed without major emotional excesses (ex. a system which has a drawdown >10-20% is not very easy to follow :))

For now my first step will be to just use this scanner as an advisor for interesting trades which could be taken. I am keen to collaborate with a fundamental analyst who can quickly give me a summary of the fundamental trend for a stock so that we can decide on whether to trade the chart pattern or not.

Keep in mind this is only a chart pattern recognition system. It is not a complete trading system yet since it does not incorporate risk management. That will be my next project.

Maybe after I make my next big loss. Perhaps I should work on the risk management part right now to avoid the next big loss :).

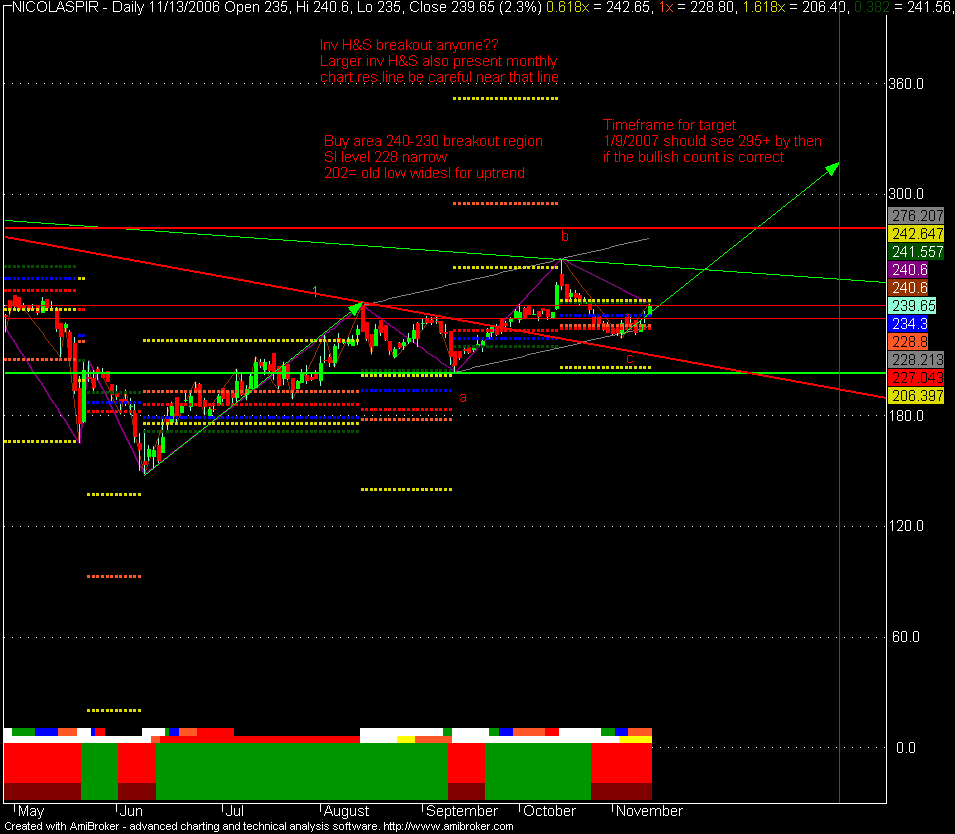

Backtest results

Backtest is done on nifty-I

results are 528% long+short

during the same period buy and hold = 1400-3900 = 274%

i sense a winner here :)

Keep in mind 528% is long+short with 1x leverage if u have more risk appetite u can pyramid and do all kinds of other stuff.

If you have ideas for a chart pattern recognition system do buzz me on yahoo:rajak1981@yahoo.com. I'm always looking to improve/add new features.

Nothing will ever beat the human eye when it comes to recognizing patterns. This system is likely to miss out some signals. On the other hand the main problem with 'eyeing a chart' is that you might not be able to backtest your strategy as rigorously as a well defined mathematical system.