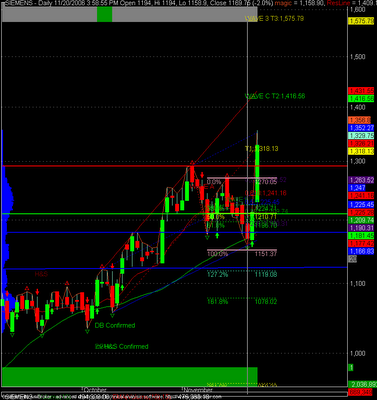

We just keep breaking levels to the upside. 3857 gave us a correction in some stocks a big one too (ex. maruti 967 corresponding level it fell 10%, ivrclinfra 367-320)

After the correction the supports held.

All supports holding so far (support for last dropped was marked as 3774, indiv stocks gave a clear signal to buy near their old tops formed a few weeks ago, ex ivrclinfra 320, abb 3330 satyam 412, sail 80-84) the depth of correction varied some stocks did very deep 10% corrections ex. sail. Nifty itself was stronger than the indiv stocks and bounced from 3789 itself.

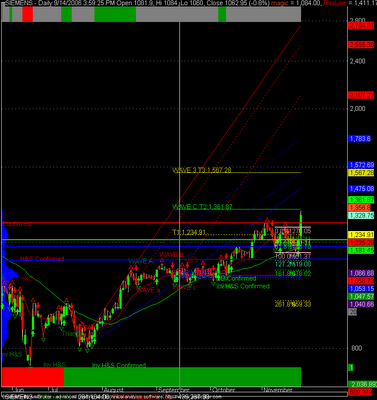

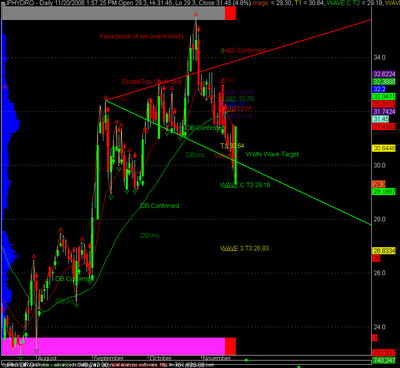

Two more pictures

Log t3 at 3978 (I rounded off to 3975 earlier on yahoo i think)

Anyway pt being , 5-8-10% correction is overdue

One such correction comes every 8 months or so

Above 4000, 4128/4200 region

Below 4000, 3650 support region